As the Summer Heats Up, So Does Fintech Funding

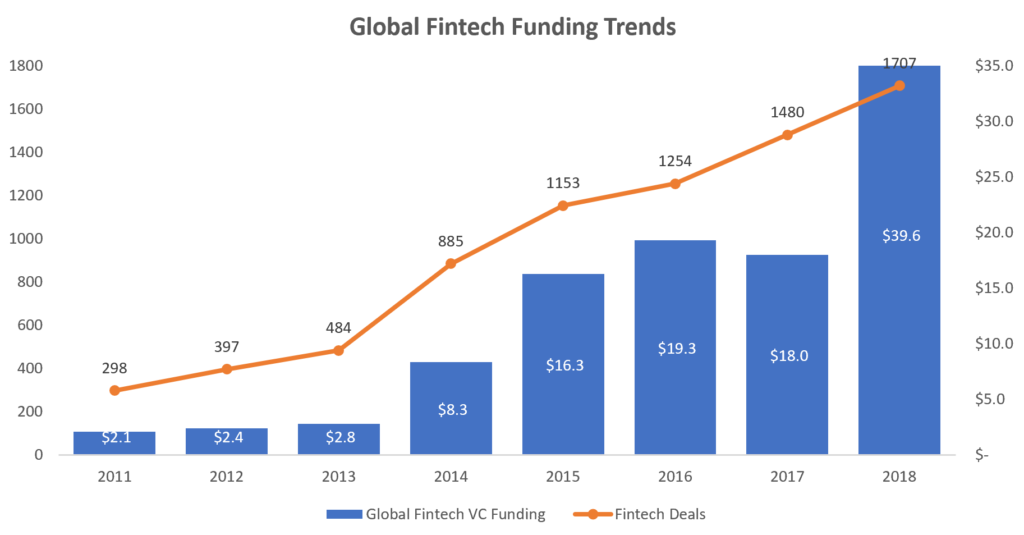

The past few weeks have seen nearly $1 billion of funding flow to five high-profile fintech startups, all of them consumer-facing, and many offering banking services. Fintech funding was once thought to have peaked in 2016, when it hit $19.3 billion, then declined to $18 billion the following year. But 2018 saw the megaraise of Ant Financial — $14 billion to one company – and a new record of $39.6 billion.

2019 fundraising may outpace those numbers. The first quarter saw VC-backed investments of $9.2 billion, up nearly 6% over the first quarter of 2018.

Investors have poured money into several established fintech startups in recent weeks. Curve, an all-in-one card solution, received $55 million in Series B funding at a $250 million valuation. London-based Curve is available throughout the E.U. It is simpler for a startup to be distributed across the E.U. than the U.S. because of stronger reciprocity laws, where a company may be licensed in Vilnius but also be available in Vienna. U.S. states are more particular in terms of money transmission, and the high cost of licensing across the 50 U.S. states is a major reason many fintechs turn to bank partnerships.

Curve allows users to add all their payment cards into one card via an app and deploy them at will. This model recalls many failed or acquired startups of years past such as Coin, acquired by FitBit during the wearable payments craze of 2016. Curve contains additional functionality, such as more rewards on top of existing card rewards, the ability to transfer purchases between cards up to two weeks after purchase, and offers a number of budgeting and reporting tools. 15% of Curve users are said to have added a challenger bank card to the app, according to TechCrunch. The newly funded company plans a 2020 U.S. launch.

Berlin-based challenger bank N26 also announced it had raised money last week — $170 million, at a $3.5 billion valuation. Available in multiple European markets and (soon) the U.S., N26 plans to use the cash for further expansion.

As N26 CEO Valentin Stalf explained it, “I think investors around the world see the disappointment customers face in retail banking. At the same time they see it’s a huge market.” Stalf said the firm’s valuation is “decent and actually low” considering its considerable growth potential. “I think the company has the opportunity to be worth much more in the future,” he said, and it seems investors agree.

San Francisco-based Varo Money raised $100 million last week in a Series C round, and also refiled its bank charter with the FDIC, according to American Banker. Varo Money is a neobank or challenger bank, but the license would make it an actual bank. This is a path almost never taken by startups due to capital requirements and other regulations difficult for startups to hurdle.

Varo obtained approval for a national charter from the OCC last year, but needs FDIC approval to allow insured deposits. The company claims 750,000 registered users and $600 million in deposits, plus $50 million in savings. This comes out to not much per customer by bank profitability standards — about $867 per customer account. Following its first attempt to obtain a charter, Varo hired two former OCC employees to add some gravitas to its compliance team.

New York-based MoneyLion raised $100 million this week and its valuation is nearly $1 billion. The company offers banklike services for a membership fee, and its card is issued by Lincoln Savings Bank out of Iowa. MoneyLion has long prioritized financial wellness, education, and personal financial management tools. It offers a discounted membership fee if users log in every day, which is not intended to gain clicks, but rather to deepen customers’ knowledge and involvement with their finances.

The neobank space is red-hot, with British challengers clamoring to enter the U.S. market, and homegrown contenders like Los Angeles-based Dave and New York-based Grasshopper clamoring for attention from customers, or at least investors. In India, Zeta, a full-stack banking solution, raised “under $60 million” on a $300 million valuation. The payment aggregation engine Finix also pulled in $15 million last week.

Six-year-old fintech veteran Robinhood, a stock-trading app, announced yesterday it had raised an eye-popping $323 million at a $7.6 billion valuation. The company said the money would be used “pursuing our mission of democratizing finance for all,” but it might be more accurate to say the money will be used to eliminate the need for an IPO and the scrutiny that comes with it.

Robinhood suffered a high-profile failure in its attempt to launch an interest-earning checking account last year, but 2018 was still a spectacular year for the company, growing users to 6 million from 4 million at the start of the year.

Matt Harris, partner at Bain Capital Ventures, told CCG Insights, “All five of those rounds are thematically consistent, in that they represent the coming to maturity of a whole crop of consumer-focused fintech companies.” Harris, one of the godfathers of fintech investing, looks at the space from a historical perspective, from the time before “fintech” was part of the common parlance.

Harris continued, “As a sector, consumer fintech has graduated from the early collection of monoline players focused largely on lending (Lending Club, Prosper, Sofi, etc.) to now a cadre of full-service bank equivalents, each with a distinctive focus but all building towards a comprehensive value proposition. It’s an exciting time.”

Investors are clearly signaling an attraction to fintech startups such as these that began as specialists and are now branching into multiple services, in a manner similar to banks. “Part of the thesis here is the rebundling idea that consumers would like to get as much if not all their financial services in one place,” said Chris Sugden, managing partner at Edison Partners. App fatigue, the reluctance to download new apps, made partnerships with platforms like Facebook very popular, but since now Facebook is radioactive (sorry, Libra) the ideal is now the all-in-one success of China’s super-app WeChat.

This means raising money, preferably lots of it. The only alternative is earning revenue, but for fintech startups with tight margins, that can be a long road.

Subscribe to CCG Insights.