Consolidation Continues Among Legacy Tech Vendors

Earlier this year the core vendors completed major acquisitions of payments platforms, with Fiserv buying First Data and FIS following that with the acquisition of Worldpay. At the time, CCG Catalyst and other industry experts predicted more of the same, and soon.

And here we are, shortly before the July 4 holiday with two more significant pickups — Jack Henry & Associates picked up the Braintree, Mass.-based PFM player Geezeo, and NCR Corporation acquired D3 Banking of Omaha, Neb.

The terms of the transactions were not disclosed. Both acquisitions are strategic, with the acquired companies adding their services to the acquirer’s product line.

Industry-watchers had been looking to Jack Henry to make a move since its two larger rivals in the core processing space announced their acquisitions. FIS, based in Jacksonville, Fla., received good news this week as European regulators signaled a willingness to approve the deal. It had long been rumored that the FIS move was likely to be fast-tracked and perhaps close before Fiserv’s acquisition of First Data, which was announced months earlier. The Fiserv First Data deal was valued at $22 billion, while FIS-Worldpay was $43 billion.

In early April, some three months after the mid-Jan. announcement by Fiserv, the Department of Justice asked the Brookfield, Wisc.-based Fiserv for more information. This was not precisely a positive development, but Fiserv executives announced later in April that the deal was still on track. Fiserv recently sold $9 billion in bonds to finance the deal.

Geezeo has been a leader in the PFM space since its founding in 2006, and has struck high-profile deals with a number of financial institutions and other fintech players. As with other PFM providers such as Yodlee and MX, Geezeo has evolved into a data analytics company, offering processing and cleaning services for transactions and other forms of financial data.

Personal financial management tools, once hidden behind a tab in online banking sites, are now standard features of newer banking apps, and are offered both by challenger banks as well as the largest banks. JHA now has a competitive product to compete with its larger rivals and help its clients compete with the big banks.

NCR’s digital banking division, acquired in 2014 and formerly known as Digital Insight, now known as Digital First Banking, is particularly strong in the credit union space. D3 is considerably smaller, claiming 3 million users, but will still bolster NCR’s digital portfolio and bring along marquee clients such as Zions Bancorporation. The move could potentially make Digital First more attractive to larger institutions.

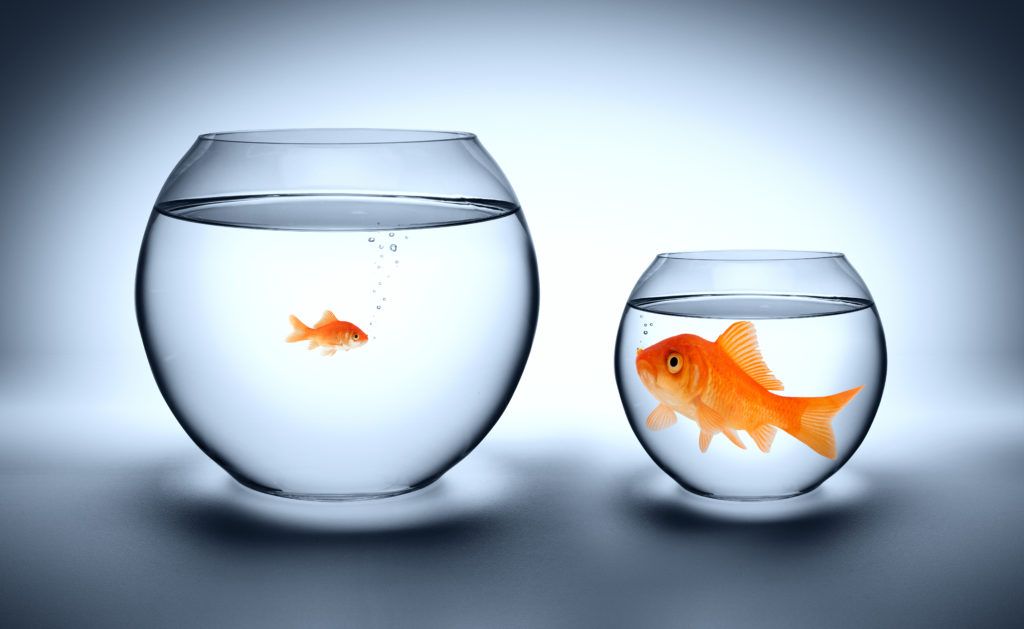

As banks consolidate, so also must vendors. The pool of banks and credit unions is shrinking, and while fintech is maturing, it will likely never grow to the size to replace the banks that are exiting the stage. There are nearly 50 fewer institutions at midyear compared with the beginning of the year, according to FDIC data.

Subscribe to CCG Insights.