PFM Made a Comeback at FinovateFall

One of the most significant demos at FinovateFall in New York this week did not win a Best of Show award.

Maybe it’s the industry’s fatigue with PFM — personal financial management. 75% of American consumers are “winging it” when it comes to planning their financial futures, CNBC reported earlier this year. InvestmentNews called financial literacy efforts (or lack thereof) in America an “epic fail.” This is bad for the American people and bad for the financial services industry.

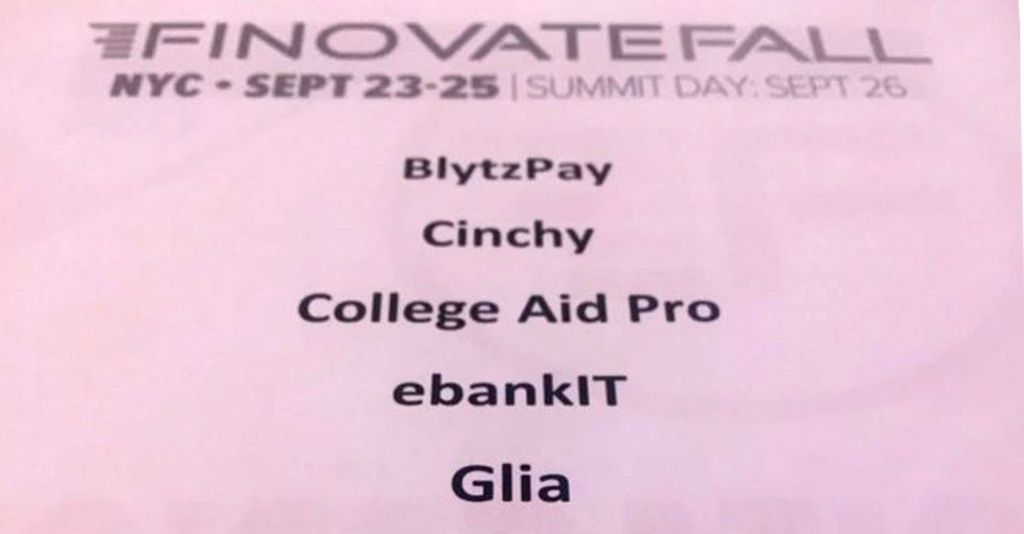

Whether it was fatigue among industry cynics or not, Envestnet/Yodlee’s presentation of its forthcoming Financial Insights API, allowing users to view their financial data in new, highly personalized ways, was not one of the nine Best of Show awardees, the list of which is pictured above

There are always some head-scratchers at Finovate. One demo opened with the statement, “Chatbots are dead!” The presenter then unironically demoed… a chatbot. Several demoes featured chatbots, as it happens.

This year’s show presented several solutions to real-world problems as well, includng multiple services that account for the growing importance of managing student loan debt for borrowers, both students and their guardians College Aid Pro and Edmit stood out here. Both allow borrowers to see the probable cost of college after scholarships and aid are taken into account, and contain databases extensively profiling each college and graduates’ likely earnings.

Other overarching themes were the importance of data (ARM Insight, Cinchy, Eigen Technologies, and more) and naturally, AI (everywhere.) There was very little discussion on stage of blockchain or cryptocurrency.

But PFM is not dead as (some say) chatbots are, it’s just deeply unpopular. Mosy users hate budgeting, we’re told. And it’s true that the less money you have, the less you enjoy staring at the number on your smartphone or desktop screen. PFM features like auto-budgeting have found their way into several neobank offerings, suggesting users want these features, they just don’t want to do the work.

Yodlee has been a longtime player in the PFM and financial data management spaces, and the presentation Tuesday hghlighted a new way users can interact with their data and produce a meaningful PFM experience. The API allows developers to build their own PFM experiences. One could focus on restaurant spend, or rideshare, showing miles traveled and ratings. The API platform for developers can be configured to produce several different slices of data based on the provided parameters and filters.

Mountains of financial data matched with configurability and AI-driven insights could make for a powerful combination.

One of the problems with PFM has always been that it’s a static experience — you enter your bank information (often against the bank’s wishes, as Wells Fargo’s recent deal with Plaid illustrates) and then you’re in a pre-built evironment delivering insights according to a preset formula. Another problem with PFM is that the users who favor it are not typically the ones who need it — struggling families may not want to take the time to linger over pie charts.

Yodlee gave two reasons why PFM has not succeeded to its satisfaction in the market so far. One is the prevalence of subscriptions, which are a major and growing driver in the economy, and are the primary way Gen Z consumers engage with digital services. Subscriptions are great — as long as you are certain to always have enough money in your account to cover them. Several standalone services will help users manage their subscriptions, but Yodlee’s presentation of one of many possible builds using its new API showed one way developers can create a service to be deplyed in a banking app or anywhere.

The second reason given by Yodlee for PFM’s unpopularity is the lack of uniformity in the market. A single person earning $100K has very different financial management needs than a family of four with an income of $60K.

“Consumers are looking for tailored financial insights that help analyze personal scenarios and identify financial pain points.” said Brandon Rembe, SVP of Products at Envestnet/Yodlee in a press release. “Our goal here is to provide insight-driven APIs to financial institutions and fintechs so they can create more personalized apps and deliver more meaningful insights to their customers in an effort to improve their overall financial wellness. These insights also offer the potential for consumers to compare their financial behavior to those in a relevant peer group for even more custom recommendations.”

The Yodlee demo showed how a subscription managment system could be configured. Yodlee detects recurring charges and organizes them where a user can see them all and cancel subscriptions, if desired. The service will alert users to prce changes or other aberratons in recurring payments. Users can see how much of their monthly budget goes to these fixed costs.

Another use case, probably much requested by parents, is a video game spending category. The software tells the user how much is being spent on video games, and allows them to set a monthly budget.

The categorization is sophisticated and draws on Yodlee’s “21,000-plus data sources,” accordng to the presentation. It allows filtering by merchant name, merchant, geo-location, and more. Right now it is aimed at developers, but PFM would have a brighter future if customers could easily configure such systems themselves.

There are also specific tools to help gig economy workers manage their less regular finances in the API. The majority of U.S. workers in 2027 will be contract workers, according to Yodlee. The new PFM software helps them track their weekly and monthly activity and plan ahead for fluctuations in income.

Financial management tools are more needed than ever, which is why the decline in PFM use is so upsetting. Banks have a duty to provide financial management tools to their customers, but often this field is being left to fintech. New solutions like Yodlee’s API can make PFM attractive to both developers and end users.

The more flexibility end users have to analyze their finances, the better, and when paired with AI, financial management tools can become great again. Bankers should consider how they are planning their own finances, and consider whether their customers have similar tools at their disposal. Automation is good. Personalization is even better.

Subscribe to CCG Insights.