Temenos Follows Familiar Path for U.S. Cores — Acquisition

Geneva-based Temenos Group is a leading core vendor for financial servces on the global market, but has yet to achieve significant penetration in the U.S. To overcome that, the company is pursuing a strategy familiar to the vanguard vendors serving U.S. banks — acquisition.

2019 has already seen massive acquisitions on the core side, with FIS-Worldpay, Jack Henry-Geezeo, and Fiserv-First Data.

This week Temenos announced the acquisition of Austin, Texas-based Kony, a prominent vendor of digital banking software. Kony’s software suite includes the development software Quantum and Kony DBX, a digital banking platform. Kony itself is still digesting its acquisition of Pivotus Ventures, a software company created by Umpqua Holdings Corp. and sold last fall. Pivotus’s main product was Engage, a platform to allow human interactions over a digital interface. Temenos’s move will further bolster its already considerable strength in digital and cloud banking.

Pivotus was an interesting case. Few banks can create technology companies and spin them off and see successful products emerge in a relatively short amount of time, but Umpqua achieved just that. To do this it did something even more unusual — it collaborated with other banks to test the software. But shortly after Engage hit the market, Umpqua sold Pivotus to Kony and the experiment was over.

The Engage platform enables banks to assign agents to unique customer service representatives. It was a way for Umpqua to retain its human touch in the digital space, according to CEO Cort O’Haver. Umpqua’s brand had been built around exceptional service and a strong in-branch experience. The bank was among the leaders in rethinking branches and repurposing them for the new era in banking, but despite that, mobile threatened to degrade the user experience to clicks and swipes. Engage was created to improve and humanize that user experience.

In December, not long after Kony acquired Pivotus, Temenos acquired Avoka, a software company prominent for its customer onboarding solution, now called Journey Manager and part of Temenos’s Digital Front Office, which serves 300 banking customers. DFO is part of Temenos Infinity, the omnichannel software front end that comprises a suite of financial products covering everything from marketing to fraud prevention. Underneath it all is Temenos’s core offering, its T24 product.

Avoka was acquired for $245 million. Terms of the Kony deal (and the Pivotus deal before that) were not disclosed.

Kony and Avoka are among the most prominent in Temenos’s acquisition history since landing in the U.S.,but two other companies were acquired after Avoka. Also in 2019, Temenos has acquired U.K.-based Logical Glue, a data analytics firm, and big data vendor Htrunk Software Solutions out of Bangalore, India.

Kony and Avoka were large companies with global reach. Incorporating their products and people will be an ongoing challenge. A criticism of Fiserv, FIS, and Jack Henry has been that they themselves no longer innovate, but rather deliver new products by buying them from smaller firms. Temenos has a greater reputation for innovation, but may suffer from the same indigestion these firms have faced in incorporating new technology and talent.

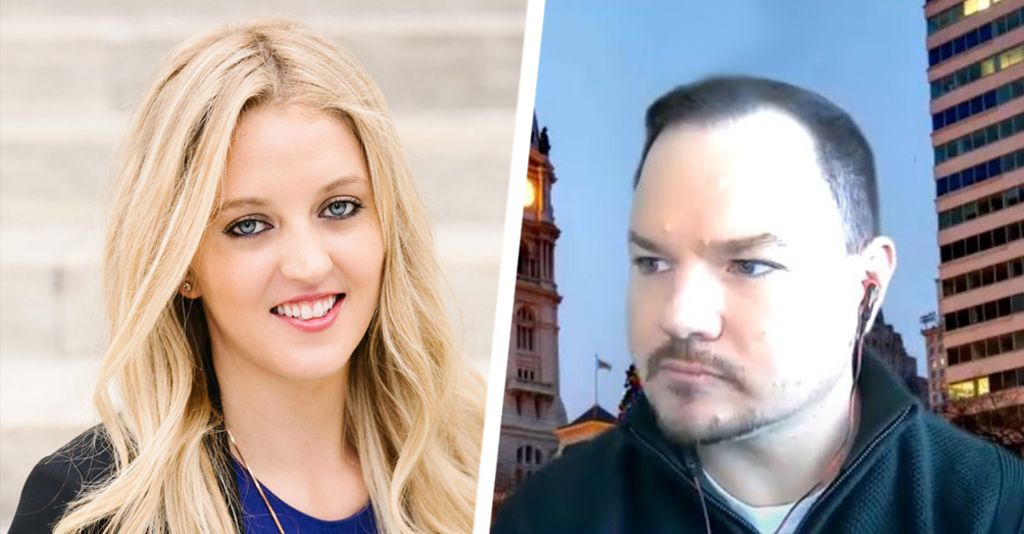

The move has also led a to a shift in the executive management at Temenos. Emily Steele, president of Temenos North America, will shift to an executive vice president role to make way for Thomas Hogan, Kony’s chairman and CEO.

Temenos’s modern core has made it an enticing choice of neobanks and digital challengers. A single modern core that can push out updates from a central location offers clear advantages over more antiquated technologies that roll out far fewer updates, and in a more cumbersome fashion.

But SaaS does not solve everything. Banks, like many consumers, are notorious for not implementing updates as soon as they’re released. Waiting to patch software can lead to serious problems, and may have contributed to Capital One’s recent woes, for example.

The acquisition of Avoka brought in 85 banking clients. Kony will bring in another 500. Added to its existing hundred of clients for its digital front end, these are also customers to whom Temenos may be able to offer its T24 core, with the promise of smoother integration and fewer vendors to manage. But Avoka also brought in several hundred employees, and Kony 1,500 more. These people and the products they support will need to find a place in the fast-growing organization.

Temenos is signalling to the market it takes its U.S. gambit seriously. Expect more acquisitions to follow. Banks with an eye to the cloud and looking to become more digitally oriented will certainly give this new Temenos a longer look.

Subscribe to CCG Insights.