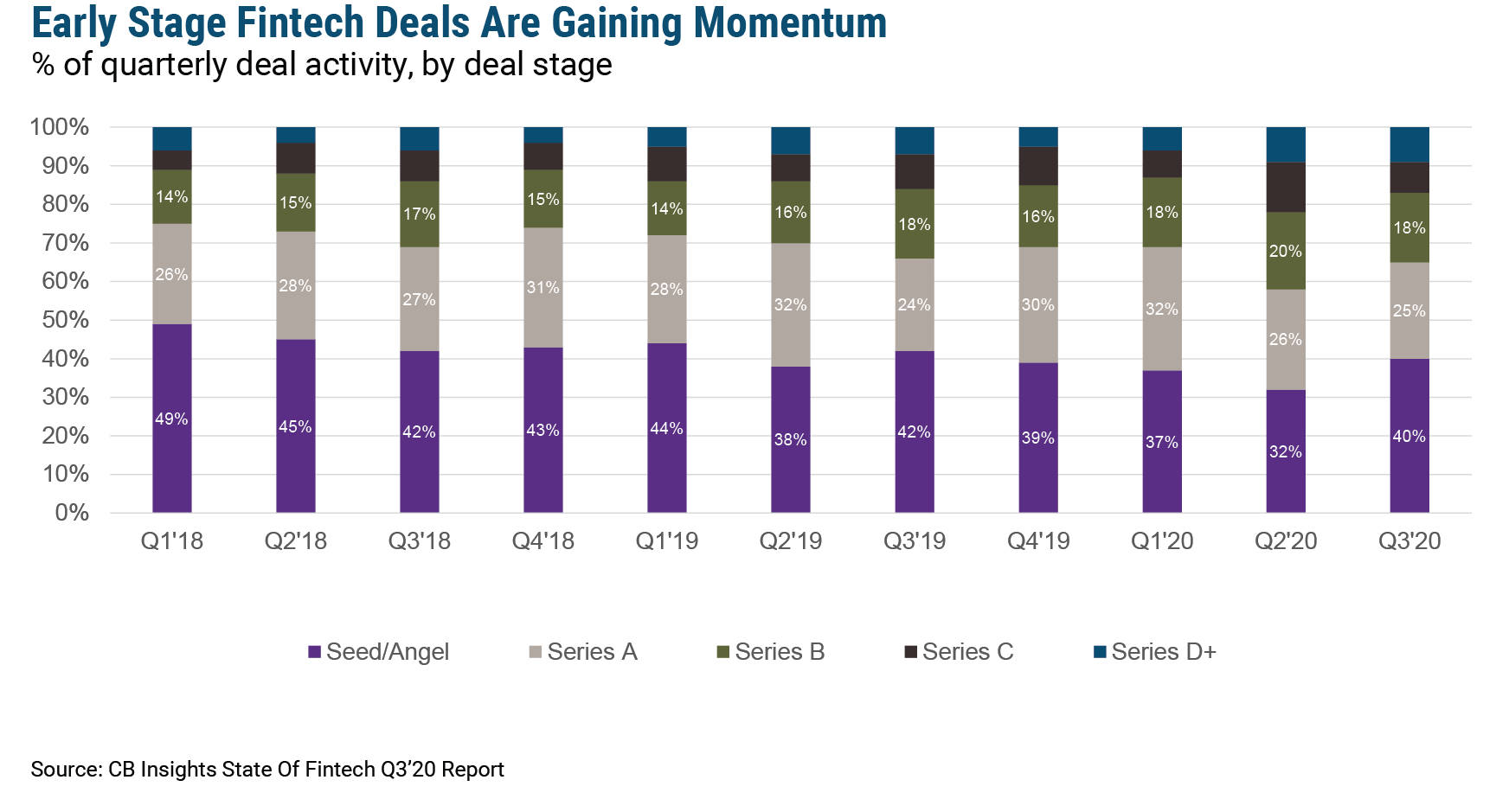

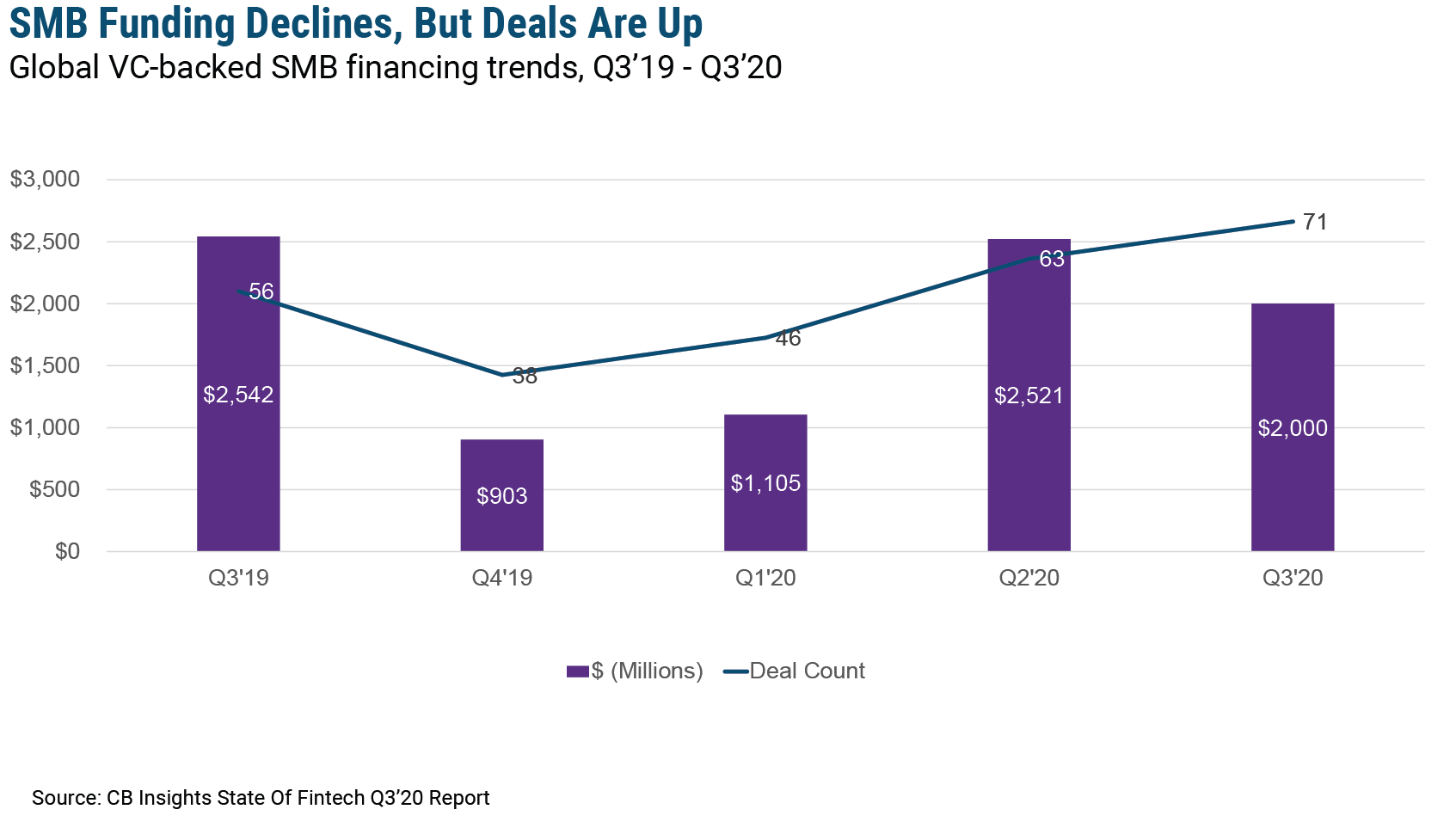

Early stage fintech deal activity is perking up as we close out 2020. According to CB Insights’ latest State of Fintech report, seed/angel and Series A deals made up a larger percentage of all deals in Q3 2020 than in the prior quarter, at 65% versus 58%, respectively. This suggests that, after several hard-hit months during the height of the Covid-19 pandemic, investor appetite for newer solutions is rebounding. While the numbers indicate this trend is sector-wide, it is likely to be especially true for fintechs focused on serving small- to medium-sized businesses (SMBs). CB Insights’ data supports this view — while funding to SMB-focused fintechs fell 21% quarter-over-quarter (QoQ) in Q3, the number of deals actually increased from 63 to 71. A lower amount of funding is being spread across more deals, potentially in a slew of smaller injections to companies just getting off the ground.

In the US, the government-mandated shutdowns and Paycheck Protection Program (PPP) put a spotlight on many issues within SMB banking that we’ve known about for a long time but never really addressed. This includes how long and cumbersome it is to onboard a new client as well as due diligence issues and a lack of robust toolsets for these customers. That’s created an opportunity for fintechs to move in to solve these problems. BoostUp.ai, for example, raised $6.25 million in a seed round in September to help businesses to better predict revenue through its data intelligence platform. And we’re seeing similar activity elsewhere in the world — Worky, an HR and payroll platform for SMBs in Mexico, raised $3 million in seed funding this past quarter, while WorkPay, a cloud-based business management tool for small businesses in Kenya, took in $2.1 million in seed funding, per the report.

The SMB segment has been neglected by larger banks and catered to by smaller ones and fintechs for quite some time. Big banks ($10 billion+ in assets) in the US are approving just about 13% of small business loan applications today, for instance, compared with around 19% for small banks, 22% for institutional lenders, and 23% for alternative lenders like fintechs, according to the Biz2Credit Small Business Lending Index. Alternative lenders are the frontrunners here, likely in part because their tech-savvy platforms often boast advanced underwriting capabilities that rely on big data. But the pandemic has demonstrated the need for tools outside of lending as well, and that’s where we are starting to see fintechs move in once again to scoop up capital and solve problems. These value-added services — from cash flow forecasting to HR and payroll support — are areas that traditional financial institutions should be thinking about today, as they may be differentiators now but could soon become table stakes.