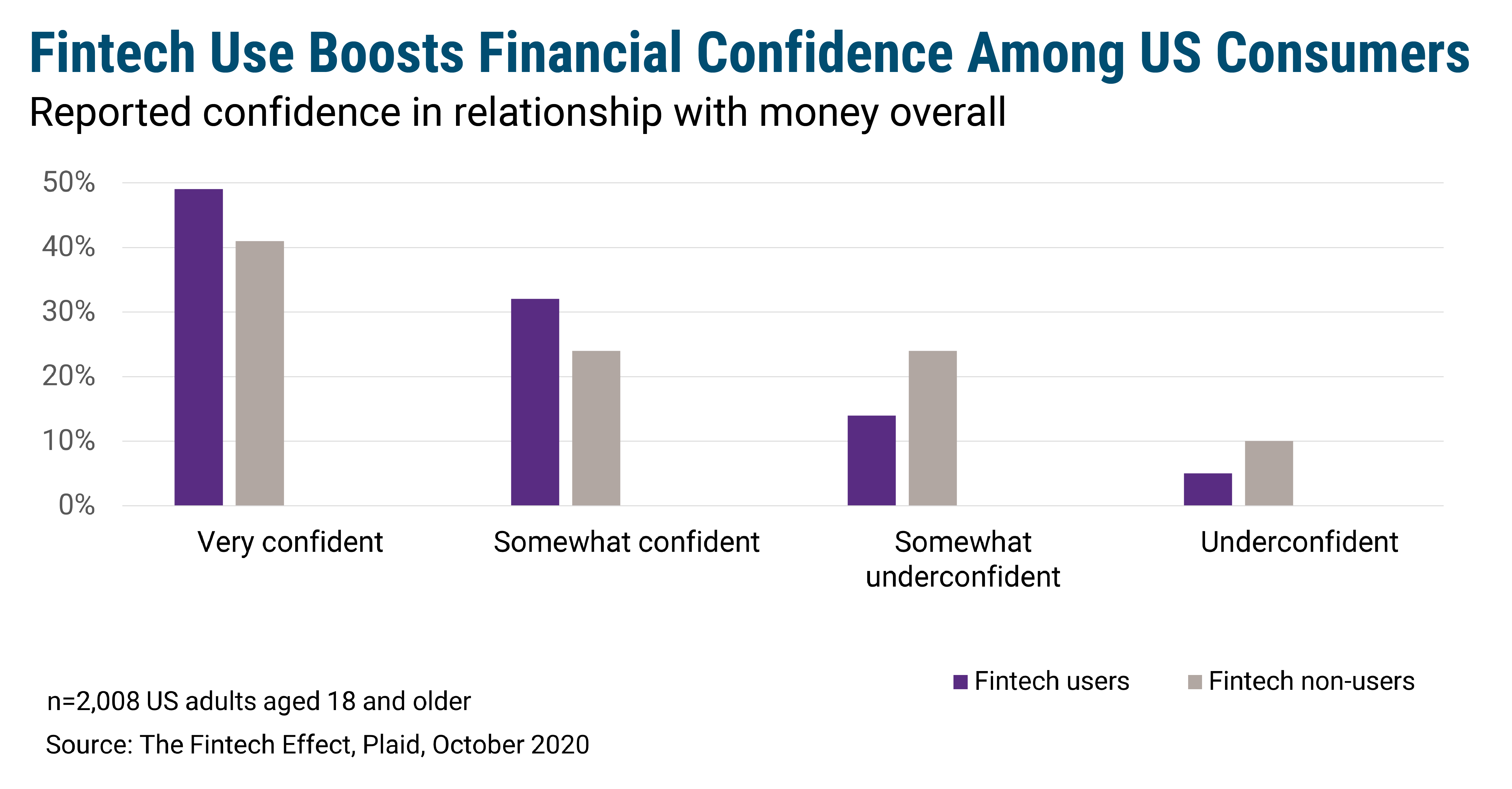

Fintech users have greater confidence in their relationship with money than nonusers, data from Plaid’s The Fintech Effect report shows. A whopping 81% of fintech users surveyed by The Harris Poll on behalf of Plaid in July 2020 said they felt either very confident or somewhat confident in their relationship with money overall, compared with 65% of nonusers. Fintech users are defined as those who use at least one fintech app.

This suggests fintechs are achieving success in their quest to democratize financial services and encourage financial health. While it’s possible, or even likely, that fintech users are more financially savvy to begin with, it’s hard to discount the impact that technology is having on their confidence — 68% of consumers said fintech helps reduce financial anxiety, while 37% felt their financial outlook improved because of it. This feeling of confidence likely stems from the emphasis on customer experience fintechs put at the heart of their value propositions. Additionally, many focus on providing ancillary services that traditional banking apps may not sufficiently cover, such as personal financial management (PFM) tools, and several include educational content on top of their core products. Investing and savings app Acorns, for example, provides money management tips and articles through its Grow offering.

Traditional financial institutions can take a page from fintechs here. A confident customer base is a valuable one. If consumers feel they are getting genuine financial support from a brand, they will become more loyal to that brand. Financially intelligent customers are also likely to be more reliable when it comes to making payments. This means putting greater emphasis on financial wellness inside of banking apps is a smart move. Banks are very well positioned to do this because of the troves of data they possess on their customers, from when they get paid to which bills they pay first. With analytics layered on top, banking institutions could provide the insights consumers need to have confidence in their financial choices from within their mobile apps. This is a win-win; consumers get access to financial coaching without having to leave their banking app, and banks get to keep their attention, the ultimate prize on the app battlefield.